what is maryland earned income credit

2020 Tax Returns Processed in 2021 by State with EITC Claims. An eligible individual who meets the income requirement levels is eligible for in-state tuition and plans to enroll at a two-year or four-year Maryland college or university as a full-time 12 credits per semester degree-seeking undergraduate applicant.

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

For a person or couple to claim one or.

. State restrictions may apply. Get information on latest national and international events more. See todays top stories.

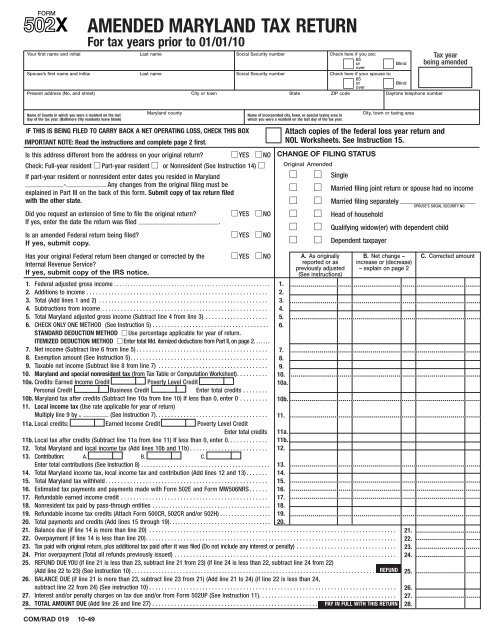

Did you receive a letter from the IRS about the EITC. Earned income is income derived from active participation in a trade or business including wages salary tips commissions and bonuses. MARYLAND TAX Check this box if you are claiming the Maryland Earned Income Credit COMPUTATION but do not qualify for the federal Earned Income Credit.

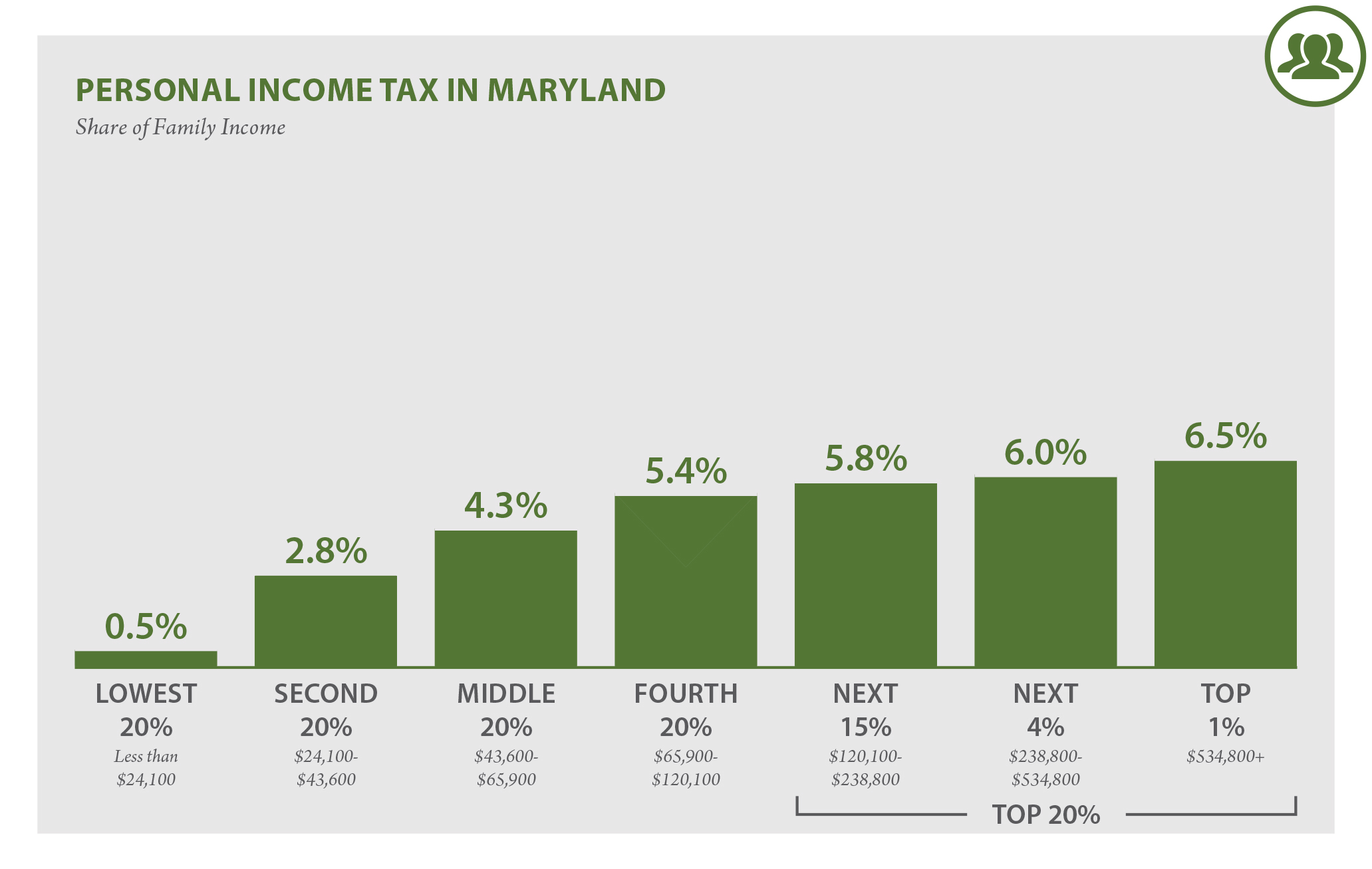

Below are statistics on current and previous years Earned Income Tax Credit EITC return by states. This as-told-to essay is based on a conversation with Amanda Nelson a 32-year-old influencer in Austin. This is the opposite of unearned income.

This study examines the relationship between income and health by using an expansion of the Earned Income Tax Credit EITC which increased benefits to households with at least two children as a source of exogenous variations of earnings. Read latest breaking news updates and headlines. If you have questions about how the health reform law will affect you and your insurance options please go to HealthCaregov or contact their Help Center at 1-800-318-2596 if you have questions.

1 estimating treatment effects on the treated using simulated EITC benefits and. The paper adds to previous work by. ˈ m ɛr ɪ l ə n d MERR-il-ənd is a state in the Mid-Atlantic region of the United States.

Mobile and Candy Crush Saga are two hugely popular mobile games published by Activision and King respectively and Microsoft could leverage these titles to help build out a game. The amount of EITC benefit depends on a recipients income and number of children. You may claim the EITC if your income is low- to.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The withholding of Maryland income tax is a part of the states pay-as-you-go plan of income tax collection adopted by the 1955 session of the Maryland General Assembly. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. If your income in 2021 is. If the distribution was for the income earned on an excess deferral your Form 1099-R should have code 8 in box 7.

Earned Income Credit EITC Advance Child Tax Credit. Call of Duty. WTOP delivers the latest news traffic and weather information to the Washington DC.

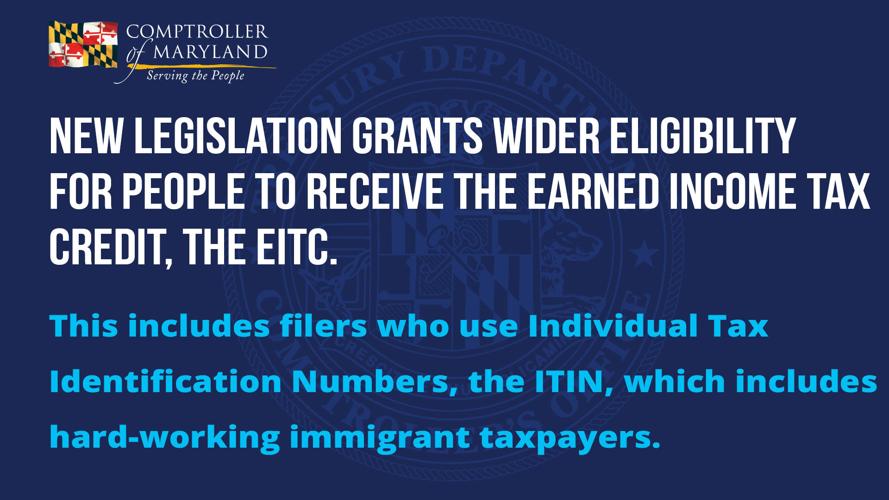

If theres a tax liability the credit is used to reduce the amount of. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. For a more detailed list of programs that do and dont use the guidelines see the Frequently Asked Questions.

An curved arrow pointing right. If the form shows federal income tax withheld in Box 4 attach a copy Copy Bto your tax return. EITC or simply EIC Earned Income Credit is designed to help working families who have low to moderate incomeA refundable tax credit means you may be eligible to receive a refund.

The table shows the number total amount and average amount of EITC claims by states. The Earned Income Tax Credit in Tax Year 2021. It indicates the ability to send an email.

Low income adults with no children are eligible. Check this box if you are claiming the Maryland Earned Income Credit with a qualifying child. Youll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040.

If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. Single head of household or qualifying widower 80000-90000 Married filing jointly 160000-180000. Earned Income Tax Credit The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

The 1099-R form is an informational return which means youll use it to report income on your federal tax return. It shares borders with Virginia West Virginia and the District of Columbia to its south and west. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments.

And Delaware and the Atlantic Ocean to its east. Add the income amount to your wages on your 2021 income. For an overview on the Credit Completion Requirements click here.

For an example of how the Census Bureau applies the thresholds to a familys income to determine its poverty status. To check the status of your Maryland state refund online go to httpsinteractivemarylandtaxesgovINDIV. Find out what to do.

A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. The Earned Income Tax Credit program also does NOT use the poverty guidelines to determine eligibility. Pennsylvania to its north.

The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. POPULAR FORMS.

Certain employees may be entitled to claim an earned income tax credit on their 2021 federal and Maryland income tax returns if both their federal adjusted gross income. Single workers with. There are many IRS tax credits that reduce taxes such as the Earned Income Tax Credit.

For the tax year 2021 a low-income taxpayer could claim credits up to 6728 with three or more qualifying. Additional time commitments outside of class including homework will vary by student. Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns or if you select other products and services such as Refund Transfer.

Baltimore is the largest city in the state and the capital is AnnapolisAmong its occasional nicknames are. For the American Opportunity Credit the education credit income limit is as follows.

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

The Right Thing To Do Md Comptroller Applauds Passage Of Bill Expanding Earned Income Tax Credit 47abc

Maryland Who Pays 6th Edition Itep

Form 502x Color The Comptroller Of Maryland

What Is The Earned Income Tax Credit Eitc Get It Back

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Comptroller Franchot Revised Individual Tax Forms Ready News Times News Com

Who Gets Checks Tax Breaks And When From Maryland S Coronavirus Pandemic Relief Act Package Baltimore Sun

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

Introduction To Tax Law Part 6 Earned Income Credit 2022 Youtube

If You Are A Nonresident Employed In Maryland But Living In A Jurisdi

The Effects Of State Earned Income Tax Credits On Mental Health And Health Behaviors A Quasi Experimental Study Sciencedirect

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/FV2ARGOS55GJZMHKMBHYHKJ5XI.jpg)

How To Claim The Earned Income Tax Credit Action News Jax

Earned Income Tax Credit Archives Montgomery Community Media

Md Latino Caucus Mdlatinocaucus Twitter

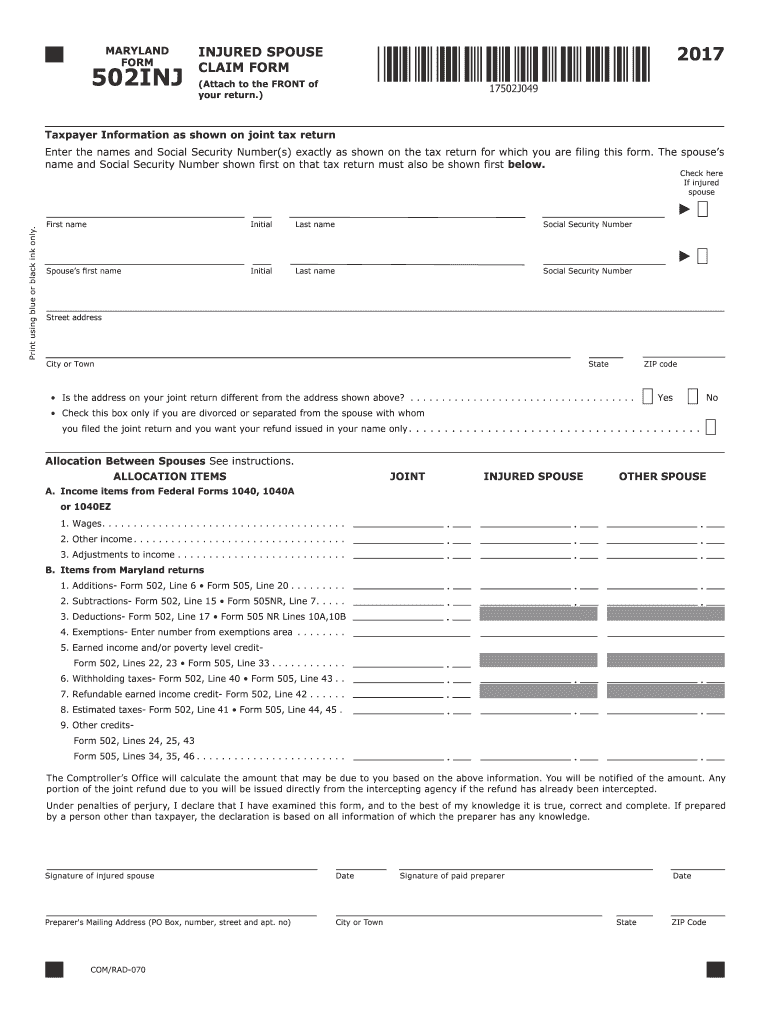

502inj The Comptroller Of Maryland Fill Out Sign Online Dochub